Sunday, 29 December 2024

Singapore Buyers Got Misled Into Investing Into Malaysia Johor Properties Under Private Lease Scheme- Slim Hope of Winning Civil Suit.

Sunday, 15 December 2024

Crazy Singapore Property Price- Price Collapse Will Lead to Bursting of People's Dream.

Wednesday, 27 July 2022

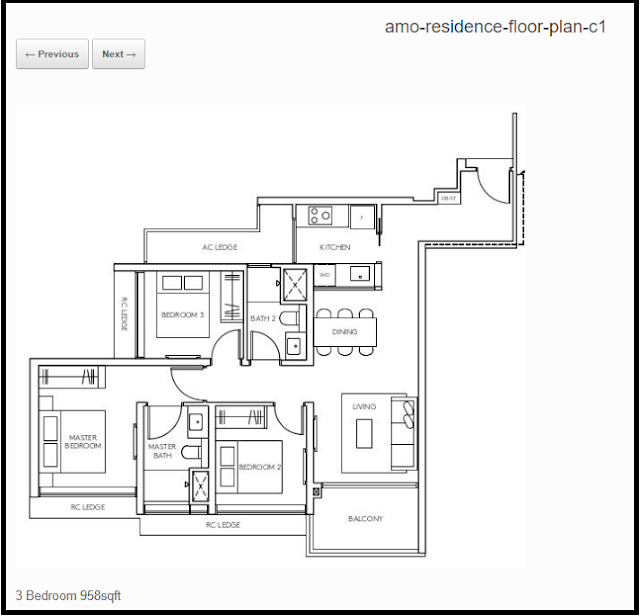

AMO Residence Over 98% Sold In A Day- Singapore Property Market Shining Bright In spite of Economic Downturn. Will You Pay S$6K To Service Your Mortgage in Outside Central Region?

|

| 3.0% borrowing rate simulation |

Monday, 12 April 2021

Property Investments Seminars Advertisements On YouTube Driving Me Nuts

From the advertisement, there is another 22 years old man that says thanks to this programme, he managed to own 2 properties "at such a young age". I think it is better to be modest than to boost about owning multiple properties. I seriously do not think this young man can own 2 properties at such a young age (unless he is really born with a silver spoon in one's mouth). Simple common sense indicates that he must have borrowed tons of money from a bank to finance his properties. Whether the 22 years old man owns 2 properties or the bank is the de facto owners the properties is only a figure of speech. If the marco-economic conditions meltdown totally and banker came to seize his property for a forced auction at the worst possible time, this young man will be in financial ruin and working as a rat (as aforesaid mentioned by the crying woman) in the rat race for the rest of his life paying off millions in bank loans.

Sunday, 31 January 2021

Personal Updates: Singaporean Venture Into Cambodia Property Investment Horror Story

Sunday, 20 December 2020

A Game Of Thrones in Condominium Disputes And Filing of Case With The Singapore Strata Title Board

Monday, 9 November 2020

Problems with Living in Singapore Condominiums- Not as glamorous as one think it is

After buying a brand new condominium and waiting for the construction to reach Temporary Occupation Permit stage typically requires 3-4 years for an average 600 unit size development. Of course, many residents could not contain their excitement upon receiving their keys and moving in after renovating their dream home. But this is where the nightmare will start.

During the 1st year, the developer will run the condo along with the appointed Management Agent. However, by the end of the 1st AGM, the MCST is supposed to elect its own Management Committee ("MC") members. Most of the good residents will not want to volunteer. In Army National Service terms, these are extra duties which snaps up valuable time especially for residents who are still working. There is also no remuneration for being in the MC to look after the estate. One will also have to deal with countless unreasonable complaints and fellow residents demanding to be served by the MC in all their requests. Hence most residents do not want to take up such thankless job.

Sunday, 13 January 2019

Parc Botannia Review- The Condo Next To Jalan Kayu Food Heaven

No of Units: 735 Units (spread over 4 blocks) and a childcare centre.

No of Parking Lots: 741 for residents and another 15 for childcare centre

TOP: Dec 30, 2021 (but expected TOP earlier in 2020 if construction progress is good).

|

| Private Lift Lobby with Built in Shoe Racks/Storage |

|

| 3 Bedder Premium |

|

| 4 Bedder-Typical |

|

| 4 Bedder Premium with Private Lift |

|

| 5 Bedder Premium with Private Lift |

(P.S: Check out the official video here of Parc Botannia and the waterfall feature wall at the grand entrance).

Sunday, 9 December 2018

Jui Residences Review- Inspired by Heritage, Designed for Quality Living

|

| Good size Infinity Lap Pool albeit small landsize. |

Saturday, 11 August 2018

High Park Residences Review and Updates- 11th August 2018

Saturday, 19 May 2018

Twin Vew @ West Coast 85% sold within single weekend of launch- S$1,399psf

Thursday, 19 April 2018

Fengshui Mythology and Properties

Do you believe in Feng Shui? Many property owners purchased their home via hiring of geomancers. Some of the principles of Fengshui are actually based on common sense. Others border along the line of absurdity.

Mythology 1: Living next to above ground MRT or LRT is a strict "No No" under Fengshui.

Even though it is super noisy, values of properties next to MRT actually commands a huge premium. For example, Lakefront Residences and La Feista (LRT track running along side). One can't always have the cake and eat it all the time. Obviously, most Singaporeans and PRs placed a huge premium over public transport convenience.

Mythology 2: Poison arrows from corner of buildings pointing in one's direction is bad.

Wow, this means most blocks of public and private housing are not livable.

Mythology 3: Unit layout must be squarish to enjoy good Fengshui. Odd shape floorplan is very bad.

Look at Clover by the Park in Bishan, the floorplan has odd shape (round) corners instead of the typical squarish/rectangular shape. So this is considered very bad? But owners who had purchased at 750 psf at launch before its TOP in 2012 would now be sitting on at least 50% capital appreciation. Huat Ar! Also, the layout that resembles clover is simply beautiful.

Sunday, 8 April 2018

Rivercove Residences review- One and only EC launch expected in 2018

Singapore Buyers Got Misled Into Investing Into Malaysia Johor Properties Under Private Lease Scheme- Slim Hope of Winning Civil Suit.

It is shocking when I read the news that some fellow Singaporean buyers are in legal dispute with a Malaysian developer over the form of o...

-

This is a follow-up posting from the last one on " Problems With Living In Singapore Condominiums- Not As Glamorous As One Think It Is ...

-

It is shocking when I read the news that some fellow Singaporean buyers are in legal dispute with a Malaysian developer over the form of o...